A New Framework

A simple framework for running a world-class angel network, distilled from our interaction with dozens of groups

Different

A few short months ago, my partners and I founded PitchFact with a mission to cultivate flourishing through efficient and collaborative early-stage diligence. Since launching, we’ve been laser-focused on understanding and supporting angel networks, and we’ve learned a few things along the way.

One of those things is that every network is very different. For example, let’s consider a common topic - member involvement level. Some groups are composed of deeply active members that write large checks and prefer to dive deep into every deal that hits their desks. These “super members” happily spend hours and hours reviewing company materials, generating robust reports to share with their peers, and chasing down relevant expertise. Others, in contrast, are composed primarily of “part-time” members who are only able to allocate a small portion of their time to the network, who write small checks, and who prefer to keep any “diligence” to a minimum. Everyone else is somewhere in between, but this one factor alone creates plenty of variance from group to group.

The Thread 🧵

Every group has a unique culture, a unique objective, and a unique group of people attending events each month. It’s one of the things that makes it so much fun to get to know a new network.

That said, here’s the tough question we have had to ask ourselves: can we build a thriving business where every engagement is unique? Where there is no consistency, other than our focus on helping improve the network’s diligence?

Sure we could. In fact, during our first-year MBA operations management class, taught by the infamous Dr. Rogelio Oliva, we reviewed a case study focused on the “job shop” process, which competes by delivering low volumes of high-quality products quickly (here’s the case link if you’re really interested). We could, in theory, have built a “one-off diligence support” organization. And perhaps there’s still a market need for this.

But as we thought about our objectives and the reason we formed this company, we realized that to truly cultivate flourishing through efficient and collaborative early-stage diligence, we couldn’t simply tackle diligence projects that varied wildly from network to network. That inconsistency is a core driver of pain for founders raising capital, for angel investors trying to run a consistent playbook, and especially for leaders seeking to form and grow their angel networks. We sensed there were consistent themes, patterns, and structures that applied across networks and across diligence reporting, and we began searching for the common thread, the things that were the same.

To start, we needed a framework.

The Power of Frameworks

I recently stumbled across this great video from Vicky Zhao, a founder and former consultant, on YouTube. In her video, she explains the power of communicating using frameworks. In my experience, some of the best and most powerful communicators speak using a variety of frameworks, and they’re incredibly helpful for concisely addressing complex topics.

As I met with angel network operators in particular, I began to notice that it was extremely difficult for me to communicate where and how our services would fit within their process. I recognize that some of that is normal with the launch of a new company - we’re still working on product market fit and streamlining our messaging. However, I believe that some portion of that difficulty is due to the absence of a simple, concise, repeatable framework that captures the essence of “what are the things a world-class angel network does well”.

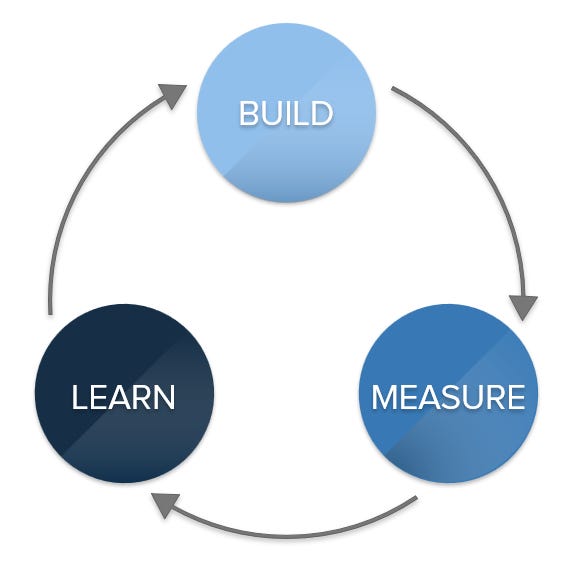

So we decided to build our process framework using another process framework: Build, Measure, Learn. If you’re not familiar, check out The Lean Startup by Eric Ries for more on this particularly helpful model. Essentially, our plan was to take what we’ve learned from all this time spent with angel networks, build a framework, measure its effectiveness, learn from those results, and repeat.

Since kicking off this adventure, we’ve spoken with dozens and dozens of angel network leaders, network members, and founders. We’ve analyzed over 170 companies, observed a wealth of pitch events, and asked a lot of hard questions. Over the next few articles, I’ll share the complete framework we’ve developed as a result of these discussions. For now, though, I’d like to share with you the core pillars.

But before I do, a quick caveat.

What this Framework is Not ❌

This framework is not intended to capture and systematize the “special sauce” of an angel network. What do I mean by “special sauce”? I mean the members. I mean the culture. I mean whatever the reason is that this particular group of people choose to spend their time together evaluating startup investment opportunities. Any of these individuals could simply deposit their cash into a fund or hire a professional to maximize their ROI and instead spend their time focused on improving their golf game.

But they don’t.

There’s something special about every single group. Maybe it’s a university affiliation. Maybe it’s a particular investment focus. Maybe everyone loves lobster tail, and getting together once a month over a meal is more invigorating when there are energetic startup founders to talk to.

Whatever it is, this framework is not attempting to systematize it. So the things that truly make a group special - that’s the stuff a leadership team must dedicate energy and time to preserving. Because if they don’t, who will?

This is also not an attempt to provide details regarding the internal workings of each step in the process. Rather, it focuses on addressing the core “jobs to be done” at each stage and is intentionally flexible in the details of its specific application. The “job to be done” concept is introduced and explained further in the late Clayton Christensen’s classic book: The Innovator’s Dilemma. Or if you have 5 minutes to spare, he explains it well in this short lecture delivered at the University of Phoenix.

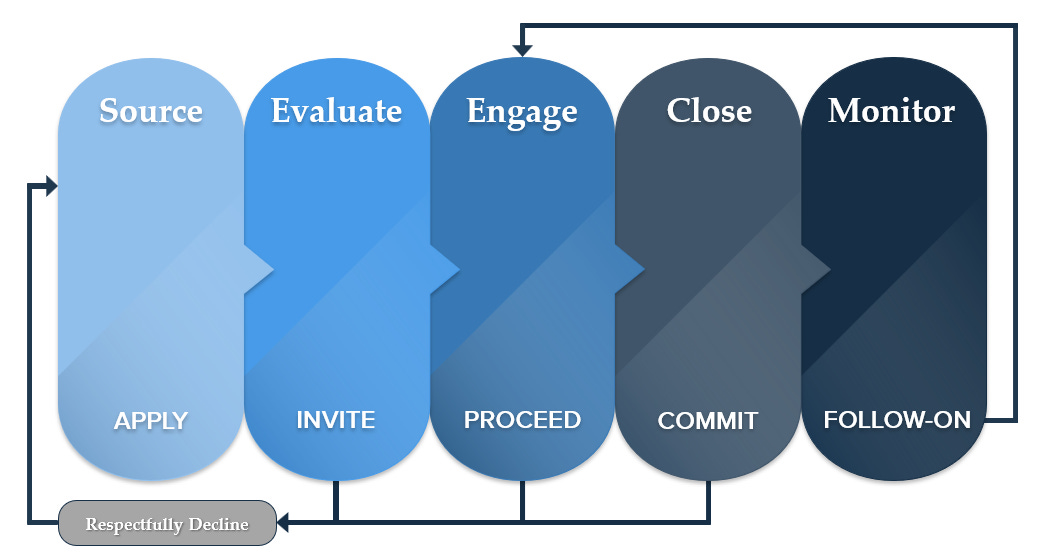

With that caveat out of the way, here are the 5 pillars of our Angel Ops framework - the parts of the process that we believe are consistent and repeatable.

Angel Ops

Each step is listed below, along with what I believe to be the core job to be done and what I call the Progressive Outcome (PO). This refers to the action or decision that moves the process forward. At stages 2-4, many deals are eliminated from consideration (see the Bonus Step), but this is the action that keeps things moving forward.

I’ll break down each step further in future articles, but for now, here’s the basic outline.

What does the process at a world-class angel network look like?

Source

Job: Bring in sufficient deal flow.

PO: Apply - Founders apply to the network.

Evaluate

Job: Identify which deals are a good fit for the network.

PO: Invite - The best applicants are invited to present.

Engage

Job: Connect these companies with the network and gauge member interest.

PO: Proceed - Deals of sufficient interest move on to receive deeper scrutiny.

Close

Job: Help members make a final decision on whether or not to invest.

PO: Commit - Members invest.

Monitor

Job: Regularly consolidate and distribute investment status updates.

PO: Follow-On - Members consider investing in following rounds, driving re-engagement with the network at a future date.

Bonus Step: Respectfully Decline

Job: Clearly and respectfully communicate to applicants when they are not a fit.

What do you think?

Since creating Angel Ops we’ve had the opportunity to review and improve it based on the feedback from many of the network leaders in our network. However, I’m always looking to improve it and include as many perspectives as possible.

Are you or have you ever been involved in forming, leading, or growing an angel network? If so, your perspective on this framework would be invaluable - I’d be honored to speak with you. Shoot me an email and let’s find time to grab a cup of coffee.

About Me

I cultivate flourishing.

I'm also the CEO of PitchFact, where we help angel networks conduct efficient and collaborative diligence. I'm a proud husband, aspiring father, and grateful friend. My love languages include brisket, bourbon, and espresso.

About PitchFact

PitchFact helps angel networks conduct efficient and collaborative diligence.

Learn more at pitchfact.com.