The Pre-Read

How angel network operators can avoid dropping the ball on the essential first job within the Engage step of Angel Ops: "Prepare and Distribute Investor Materials"

Quick Question

Are you busy?

If you’re like most of us, juggling the responsibilities of life leaves little free time to spare.

Now Imagine

You are the Chief Revenue Officer of an industrial technology company with 5,000 employees that booked $2.3 billion in revenue last year.

You are in charge of growing that number to $2.5 billion this year.

Your working time is worth hundreds or thousands of dollars per hour.

You attend dozens of meetings each week, where you are consistently asked to make decisions that will impact thousands of lives.

You do your best to enter each meeting prepared and ready to contribute but have precious little time to allocate toward each one.

Your teams know this, and at least 24 hours ahead of each meeting you typically receive a pre-read, which contains the meeting agenda, attendee list, objectives, discussion points, and a copy of any slides or other material being presented.

Do you always have time to review these pre-reads?

No.

But you always have the option to if you decide that is a good investment of your valuable time.

And when the boss asks you a question about that distribution channel meeting last Tuesday, where do you turn for help jogging your memory?

The pre-read.

Fast Forward

You retired early at the age of 54 but have plenty of gas in the tank. You want to leverage your skills by helping and investing in early-stage industrial tech companies.

So you join your local angel network.

Before you know it, the day before your first official pitch event has arrived. You expect to hear pitches from 4 interesting startups and are looking forward to participating.

To make sure you’re ready to go, that night you hit the network’s website.

What do you expect to see?

The pre-read.

Prepare to be Disappointed

To your surprise, the only information available on the static webpage is a simple agenda with the names of the 4 presenting companies.

Frustrated, you spend 20 minutes doing some light googling to at least learn something about these companies, but you’re only able to confidently locate websites for 2 of them – the other 2 have fairly generic names and there’s no way you’ll be able to find the right webpages. Even worse, the 2 that you did locate have incredibly basic sites with scant information about the company or the deal. How on earth are you supposed to contribute without being at least somewhat informed?

Eventually, you resign yourself to going in blind. You shut down the computer with a sigh, accepting the reality that no real decisions will be made tomorrow - you’ll just have to schedule some follow-ups on your own if anything looks interesting.

Here’s the Deal

Your time is valuable.

Founders’ time is valuable.

In this story, the angel network operator made the all-too-common mistake of devaluing both. They dropped the ball on the very first job during the Engage step of Angel Ops: to Prepare & Distribute Investor Materials (AKA: the pre-read).

So, what does that job involve?

I’m so glad you asked.

Angel Ops Step 3: Engage, Supporting Job #1: Prepare & Distribute Investor Materials

As a quick refresher, Angel Ops, which I introduced in this post, seeks to map an answer to the following question: What does the process at a world-class angel network look like? Angel Ops is focused on the backend process of running deals and groups the workflow into 5 core steps. In last week’s article, I introduced the third step in the framework: Engage. The objective of this step is to connect the best applying companies with network members and gauge interest, which culminates in a decision to proceed with deeper scrutiny.

Engage

Job: Connect the best companies with the network and gauge member interest.

PO: Proceed - Deals with sufficient interest move on to receive deeper scrutiny.

Within each core step, there are 3 “supporting” jobs-to-be-done that contribute to the primary job. This week, we’ll explore the first supporting job within the third step: Prepare & Distribute Investor Materials.

Why are Pre-Reads Essential?

Last week, I discussed the role of the “pitch” in helping an angel investor consider whether a startup opportunity could be a good fit for their portfolio. But one of the other things I’ve noticed is that the best network operators recognize that the pitch event is of critical importance to their success, not just the founder’s (since the basic function of an angel network is to consummate deals). As a result, these network leaders are motivated to go the extra mile. They don’t just leave it to the founders to tell the whole story. No, they work hard to equip their members with the information needed to make an effective and efficient decision about the opportunity before them.

So how do “investor materials” help network members make better decisions?

3 Ways Investor Materials Level up the Investor Experience

There are 3 basic things investor materials can provide that help members make more effective and efficient decisions:

Consistency

Founder decks often vary wildly in their structure and in the information provided. Well-formatted investor materials that are consistently structured over time resolve some of that inconsistency for investors. These materials provide them with a bedrock of information to rely on. Instead of wasting precious Q&A time asking “What vehicle are you raising on?” or “What’s your valuation again?” because yet another founder forgot to mention it during their presentation, a well-designed set of investor materials can answer those commonly asked questions ahead of time. This enables investors to skip the basics and engage founders in richer discussions. This also equips investors with the ability to easily compare deals on a level playing field, since the information they’re given is formatted consistently from deal to deal.

Another Perspective

Founders are, naturally, strong representatives for the “bull” case on their company’s prospects. If they weren’t, they shouldn’t be working there, and they definitely shouldn’t be pitching a group of angels for investment. Given that reality, some level of third-party analysis, commentary, or summarization can be an extremely powerful “sanity check” to help an investor think critically about the opportunity in front of them instead of being swept away by the founder’s evangelistic fervor. This is especially helpful for newer, less experienced investors.

A Starting Point

As we saw in the example above, going in blind is uncomfortable for many investors. Even if they choose not to review investor materials prior to the event, the option to do so is important. It gives the investor a sense of control and the ability to walk into a room prepared and ready to contribute. It also saves them time. Instead of starting from scratch if they’re interested in a deal, the materials make key information readily available beforehand, allowing their personal diligence process to be more focused and productive.

So, What Should Investor Materials Look Like?

At most of the pitch events I’ve attended (though not all), network members were given access to an agenda and some kind of information packet prior to the event kicking off. As we’ve already discussed, this information serves as a supplement to the founder’s pitch deck.

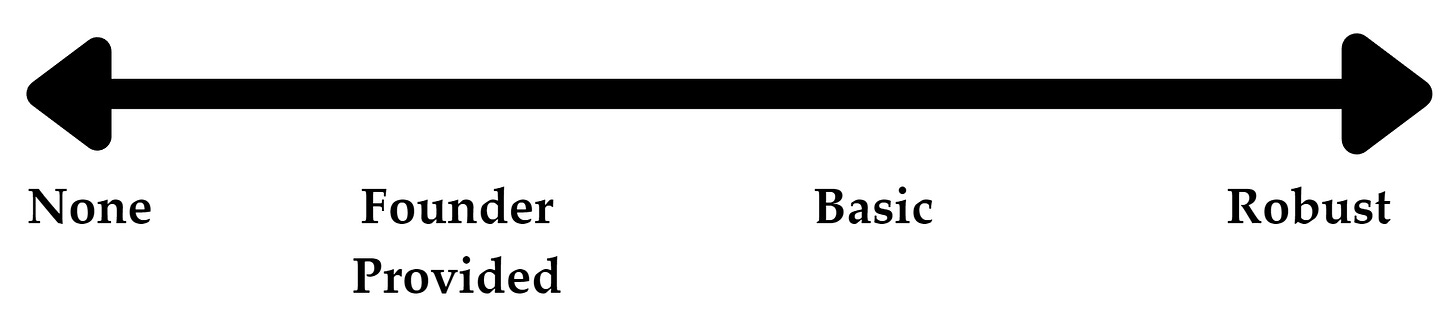

Investor materials can range in complexity from “nothing” to what I call a “robust” analysis. Below is a simple scale illustrating how I think about this. The further a community moves to the right, the more resources are required to deliver, but the more valuable the materials are for each individual investor’s decision-making process.

How Complex Should Investor Materials be at My Network?

Well, that depends on a few factors, such as:

Budget & Resource Availability

The more robust the investor materials, the more expensive they are to prepare in terms of time, process management, and direct expenses. Asking a founder to provide some additional information or assigning a student to prepare a summary of company details is relatively straightforward and inexpensive. But for communities that aspire to maximize the value of their investor’s time, robust analysis can take many forms and require substantial investment. For example, one style of report that our team developed includes 6 pages of analysis covering company essentials and 4 sections of critical importance to every deal: Market, Traction, Opportunity, and Team. This kind of thorough analysis from specialized diligence service providers saves investors many hours of research and provides them access to high quality information they would have been unable to collect on their own.

Average Check Size

If a community tends to write small checks in aggregate (“small” is relative, but let’s say $25,000 or less for the sake of argument), it’s often not worthwhile to dedicate much time or energy to developing more than a basic form of investor materials. On the other hand, if a community tends to (or aspires to) write larger checks, it can be extremely beneficial to invest in frontloading as much analysis as possible to help streamline the process and minimize the need for post-pitch diligence.

Member Expectations

Some communities prefer a DIY approach to all company research, and encourage their members to conduct all diligence, from beginning to end, on their own. In this case, it is unhelpful (and often impossible, since the budget is likely to be very small) for an operator to deliver more than a simple agenda ahead of the pitch event, since members plan to do all the research themselves. Other communities prefer the “white glove experience”, and appreciate the value provided by robust investor materials. These networks often have larger budgets, charge higher member fees, and aim to deliver a “premium” experience. It’s up to each individual network operator to recognize the preferences and needs of their members and to develop investor materials appropriately suited to those needs.

Final Thoughts

Investors are busy, and they generally expect some level of pre-read. As a result, preparing and distributing investor materials is an essential job for the angel network operator. This information provides investors consistency, a different perspective, and a starting point for their own diligence, though the complexity of these materials should always be thoughtfully tailored to fit the unique needs of each community.

What do you think?

What does your angel network typically provide ahead of the pitch event? Are those materials lacking, too intense, or just right? Do you think of your angel community as a “budget” network or a “premium” network?

Weekly Observations: 3 Lessons Learned

🙅♂️Strategy is as much about defining what not to do as what to do.

In B-School, we took an entire course called “Business Strategy”. In it, we studied writing from strategic thinkers like Michal Porter, Clayton Christensen, and more. We reviewed dozens of case studies, put ourselves in the shoes of business decision-makers throughout history, and analyzed the outcomes of the actual decisions that were made. This week, as I listened to an episode of Invest Like the Best where Rebecca Lynn, who founded Canvas Ventures, spoke with Patrick O’Shaughnessy, I was struck by a question she likes to ask founders: “How many potential customers have you said no to?” Maintaining focus is very difficult when you’re like me and get easily distracted by shiny new things.

🔍Know the facts.

This week I read “Ogilvy On Advertising” by David Ogilvy (1911 - 1999), who was an advertising legend during the mid-20th century. I learned about the book thanks to a very practical podcast episode from David Senra, which I highly recommend. It’s chock full of timeless advice and examples, but one of the things that stuck out to me was his obsession with making advertising decisions based on what does and does not deliver results. He quotes the Benton & Bowles agency’s belief that “if it doesn’t sell, it isn’t creative,” and clearly relies upon this throughout his career. In the book, he relentlessly cites studies, surveys, and performance data for every factor imaginable. Here are three examples that stood out to me on the topic of headlines alone:

“…advertisements with headlines that promises a benefit are read by an average of four time more people than advertisements that don’t.”

“On average, five times as many people read the headline as read the body copy.”

“When you put your headline in quotes, you increase recall by an average of 28%.”

🔄🔄Two iterations make stuff exponentially better.

This might seem obvious, but most first drafts suck. Even if I think something I’ve made is great, our team has consistently found that by submitting things for review and taking at least 2 passes at the document, deliverable, proposal, plan, etc, the final product comes out exponentially better. It takes a lot of time, but one of our company values is “Highest Standard”, and we’ve naturally evolved into a culture of expecting at least 2 iterations and feedback loops on important deliverables before calling them “done”.

Thanks for reading, have a great week.

-Andrew