Don’t Miss the Bus

My freshman year in college was rough.

As an engineering student, I’d show up for class, study all day, and catch the last bus home around midnight.

Except when I missed it.

More than once, I’d come up for air from the delightful physics practice exam I had been taking and realize it was 1 a.m.

Not fun.

Of course, I had plenty of other options. I could spend the night on campus, walk home (about 5 miles), bum a ride, pay for a ride, or some other creative option.

The point is, since I missed the bus, I had to figure something else out on my own.

The Observer Express

Don’t have time to read the entire post right now? No worries, here are the main points:

Members of an angel network trying to invest in a deal are like freshman Andrew trying to get home. They can figure out how to get there on their own, but if there’s a bus available, they’d like to take it.

Therefore, members need to know when the bus is leaving, where it’s going, and that there will be someone driving the bus and helping them aboard.

This clarity gives members the ability to choose whether or not to participate alongside the network and frees operators from babysitting a deal forever.

Essential Infrastructure

Investors join angel networks for plenty of different reasons.

However, one that is consistent (and often required for membership) is that they intend to invest in one or more deals they identify through the network.

Just like I chose to rely on the bus to help me get home, members often rely on their network to help them get a deal done.

Now, this doesn’t apply to every member. For example, some of my peers had their own cars, lived on campus, or had other means of transportation. They were just fine doing their own thing. Many investors are the same way - they prefer to do their own thing. Once they’re introduced to a deal they like, they’ll run with it.

But for me, and for thousands of other students at Texas A&M, that bus route was essential. In the same way, many members depend on the network’s infrastructure and processes to help them land a spot on that interesting startup’s cap table.

The Wild West

In my experience, many angel network operators struggle with process management after the Pitch Event. Things tend to devolve into a “wild west” situation, where members and founders are expected to “figure it out on their own.” While that works great for the members who prefer to “do their own thing,” this hands-off approach can limit network growth by relegating a significant percentage of investors to a disappointing experience.

Perhaps the investor is new to the game and would like more guidance. Perhaps they write small checks and prefer to join forces with co-investors to boost negotiating power. Perhaps they trust their peers and enjoy being in the same deals as their friends. Perhaps they’re simply busy and don’t have time to trudge through all the steps on their own. Or perhaps there’s something else entirely that is motivating them to look to the network for support.

Whatever their reasoning, the point is that this is a critical point in the process, and network operators must support their members across the finish line.

That’s where Angel Ops Step 4 comes in.

Step 4: Close

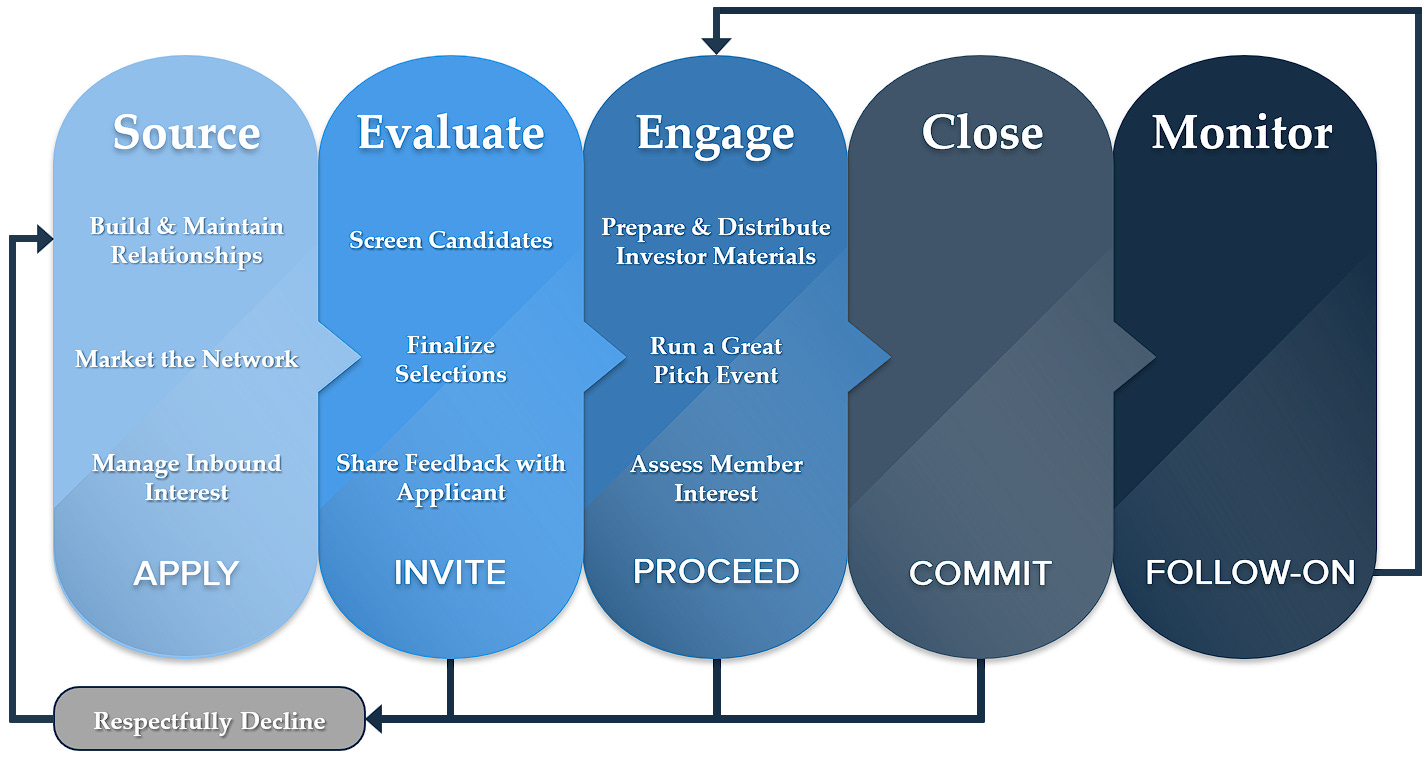

As a quick refresher, Angel Ops, which I introduced in this post, seeks to map an answer to the following question: What does the process at a world-class angel network look like? Angel Ops is focused on the backend process of running deals and groups the workflow into 5 core steps. 2 weeks ago I wrapped up the third step, Engage. Over the next few weeks, we’ll dive into the fourth step: Close. The objective of this phase is to help community members make a final decision on whether or not they’d like to invest, which culminates in the making of a commitment.

Step 4: Close

Job: Help members make a final decision on whether or not to invest.

Progressive Outcome: Commit - Members invest.

Within each core step, there are 3 “supporting” jobs-to-be-done that contribute to the primary job. We’ll explore each of the supporting jobs for the Close step in the weeks ahead. For now, let’s double-click on the overall job for the network operator at this point in the framework.

On or Off?

No matter how good the process is, angel networks are generally structured in such a way that individual investors must make their own investment decisions. They ultimately choose to get on the bus or not.

What’s important for the network operator is to focus on making the infrastructure run. That means making it clear when the bus is leaving, where it’s going, and ensuring that there is someone driving the bus and helping members get on board.

When the Bus is Leaving

Member Questions: What is our network’s process for closing deals? What are the next steps after I’ve indicated my interest? Where do I need to be and when?

Where the Bus is Going

Member Questions: What is the vision behind this investment? What is our thesis on this deal? Does the network draft documentation or keep record of the vision?

Someone is Driving the Bus

Member Questions: Who is driving the deal? Is it a member, network leader, or someone else? Who can answer my questions and make sure I’m up to date?

Two Benefits of a Great Closing Process

This clarity and consistency do two things for the network:

Provides members the ability to choose whether or not to participate alongside the network or not.

Provides network operators a “release” of obligation to continue supporting the deal. Not once in the example above did I consider calling A&M Transportation and asking for the bus to come back - they did their part, I just missed the window. In the same way, a well-structured closing process liberates network operators from being expected to support a deal indefinitely.

Final Thoughts

Angel network members are perfectly capable of executing a deal on their own, and many do. However, facilitating a clear and consistent process to help guide members across the finish line is well worth the effort. That’s the focus of Angel Ops Step 4: Close, and is something we’ll explore in much greater detail in the coming weeks.

What do you think?

What should an angel network operator’s role be in the closing process? How “hands-off” or “hands-on” is your community?

Weekly Observations: 3 Lessons Learned

Infrastructure is very important. 🌉

This week I attended “Angel Investing in the Energy Sector” hosted by the Houston Angel Network at the Rice University campus. My biggest takeaway was that no matter how revolutionary it may be, new technology is impossible to commercialize if the fixed cost to deploy it exceeds the value it delivers.

Invest in the good wrapping paper - it matters.🎁

This week we rolled out a total visual refresh of our flagship diligence report. We delivered 5 new reports for an event on Friday, and not only did I receive a half dozen separate in-person comments about how much people liked it, but the average report viewership and duration also increased relative to prior months. it was the same content as usual.

Defining a clear strategy is hard, and takes more work than you’d think.🧠

I spent most of Labor Day working on our strategy. It was hard work and was made even harder by the LONG list of to-do list items I chose not to spend my time on. In that vein, I’m reading “Playing to Win: How Strategy Really Works” by A.G. Lafley and Roger Martin, and I’d like to share an excerpt that hit me right between the eyeballs:

“In short, strategy is choice. More specifically, strategy is an integrated set of choices that uniquely positions the firm in its industry so as to create sustainable advantage and superior value relative to the competition. Making choices is hard work, and it doesn’t always fit with all the other work to be done. In our view, far too few companies have a clear, choiceful, and compelling winning strategy in place. Too often, CEOs in particular will allow what is urgent to crowd out what is really important. When an organizational bias for action drives doing, often thinking falls by the wayside.”

Thanks for reading, have a great week.

-Andrew