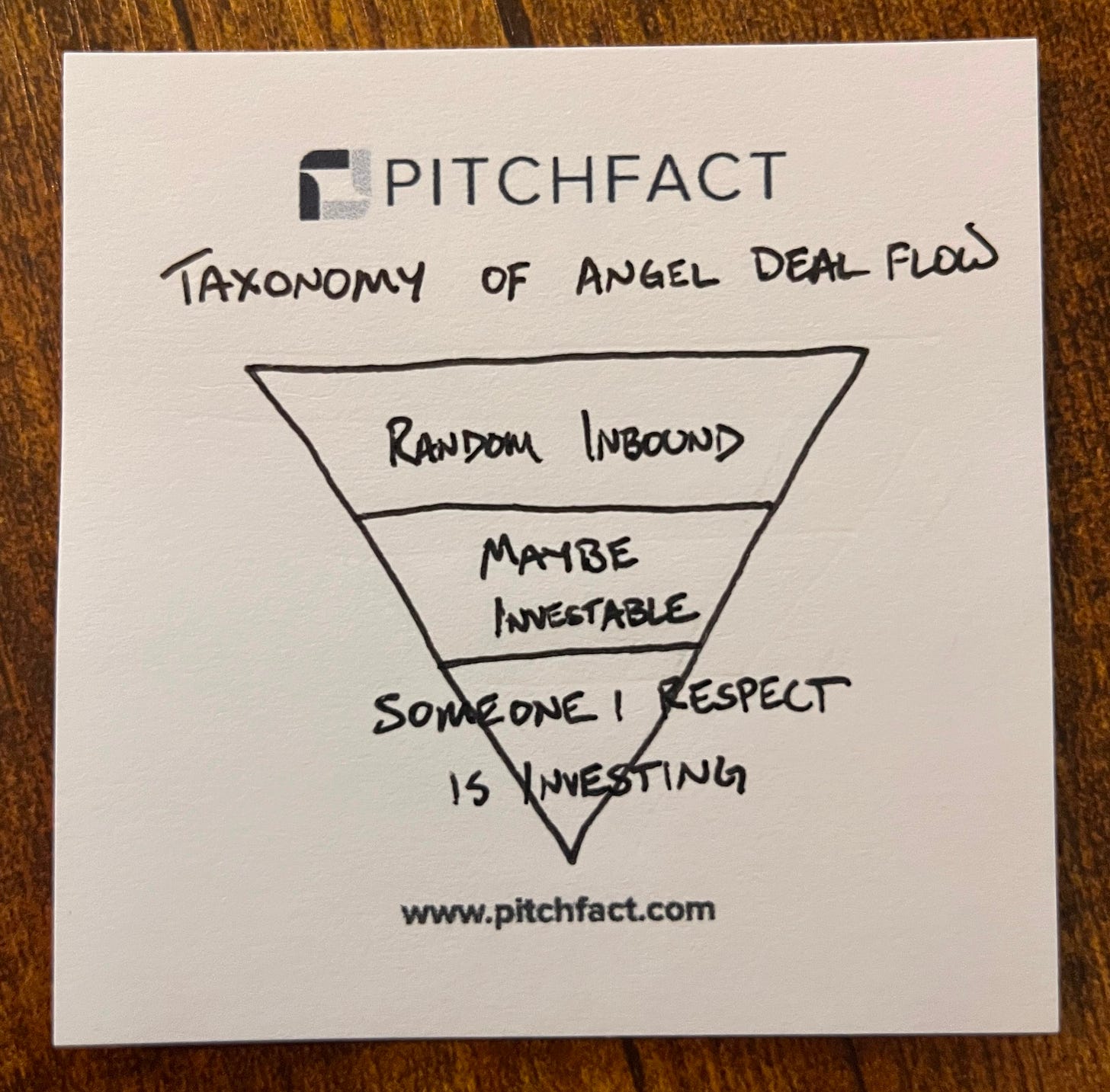

Taxonomy of Angel Deal Flow

A shortcut to deciding "Is this deal actually worth taking a closer look at?"

“We need more deal flow.”

Sound familiar?

Hot take: it’s not true.

Nobody has a deal flow problem. We’re all drowning in deals. In 10 minutes anybody can sign up for 10 dealflow sites and have access to hundreds of opportunities.

What we really have is a quality deal flow problem.

What’s the Shortcut for Quality?

As of November 12, 2024, my team and I have looked at 1,017+ deals on behalf of our customers. Most of them were awful, but a few were fantastic.

It takes a lot of time to give each deal a fair look.

Most of us don’t have time to go deep on every deal that hits our desk.

So, in this post, I’m sharing the 3-step mental model I’ve developed along the way for quickly sussing out if a deal could be “quality” and worth taking a closer look at.

Taxonomy of Angel Deal Quality

Random Inbound.

The cold email.

The LinkedIn request.

The initial application to the angel network with no prior relationship.

→ Most of this is an “insta-pass” because it clearly doesn’t meet basic criteria.

Maybe Investable.

Passed some kind of initial screen/filter.

Maybe a friend I trust said they’re worth taking a look at & they thought of me (but they haven’t invested).

Maybe my angel group had a screening call with them.

→ Warrants consideration but “some assembly required” to make sure it’s worth the time to really double click.

Someone I Respect is Investing.

I’m 100% doing a double-take here.

“Oh, Jenny invested? She’s sharp, I know she wouldn’t do that unless there was something special here. I’d better take a closer look.”

Strong signal from trusted peer(s).

→ Definitely worth closer attention.

Caveat

This framework is a terrible standalone benchmark for quality. Please please PLEASE don’t write a check just because your buddy did. Do your own diligence.

But when it comes to deciding “Is this one deal out of the deluge of deals I swim in every month worth a closer look?” It’s invaluable.

2 Nuances

Lead investors tend to prefer level 2 deal flow. They want in before the rest of the world discovers the deal.

Follow-On investors like most angels strongly prefer level 3 deal flow.

Final Thoughts

It’s common practice in the angel community to share deals. There’s an important quid-pro-quo mindset where investors really do rely on one another for access to interesting opportunties. But not all opportunities are created equal - someone who wants to be seen as a source of “high quality” deal flow should be personally investing in the things they’re sharing and/or ensuring that someone they respect is investing.

-Andrew

P.S. We’re piloting a way for angel communities to access & share ONLY level 3 deal flow with each other. Click here or reply to this email to learn more.

About Me

I cultivate flourishing.

I'm also the CEO of PitchFact, where our mission is to cultivate flourishing specifically through efficient and collaborative early-stage diligence. I'm a proud husband, grateful father, and honest friend. My love languages include brisket, bourbon, and espresso.