What's the News?

How angel network operators can level up the member experience by monitoring deal status and performance over time

Public vs Private

Buying $25,000 of equity in Amazon is a very different experience from buying $25,000 of equity in a hot new e-commerce startup.

Let’s consider a few of the differences:

Amazon

1.5 million employees working around the world (Source)

$514 billion in revenue last year (2022 10K)

Highly liquid, publicly traded securities

Regular earnings calls, updates, and news briefings

An army of analysts publishing regular assessments of the company’s position

E-Commerce Startup

2 employees working from home

$2,500 in revenue last year from 3 pilot tests

Highly illiquid, generally dependent upon a liquidity event (M&A, IPO, etc)

Quarterly investor email updates (if we’re lucky), often requiring manual outreach

No analyst coverage - primarily reliant upon personal analysis

Why This Matters

It’s easy for an investor to keep up with the latest news about their investments in a large public firm like Amazon. It is not easy for an investor to keep up with the latest news about their investment in a small private deal.

This challenge becomes even more difficult when an investor builds a portfolio of multiple early-stage deals to keep up with. And they have a day job to manage. And a family to raise. And a million other things.

That’s where angel networks can help.

The Observer Express

Don’t have time to read the entire post right now? No worries, here are the main points:

An angel network operator has an important role to play post-investment.

In my experience, angels tend to have lots of questions - they want to know what happens to the deals their network has invested in, even if they chose to pass.

It’s a lot of work to follow each deal personally, so members tend to rely on the network operator to consolidate and share updates.

Step 5: Monitor

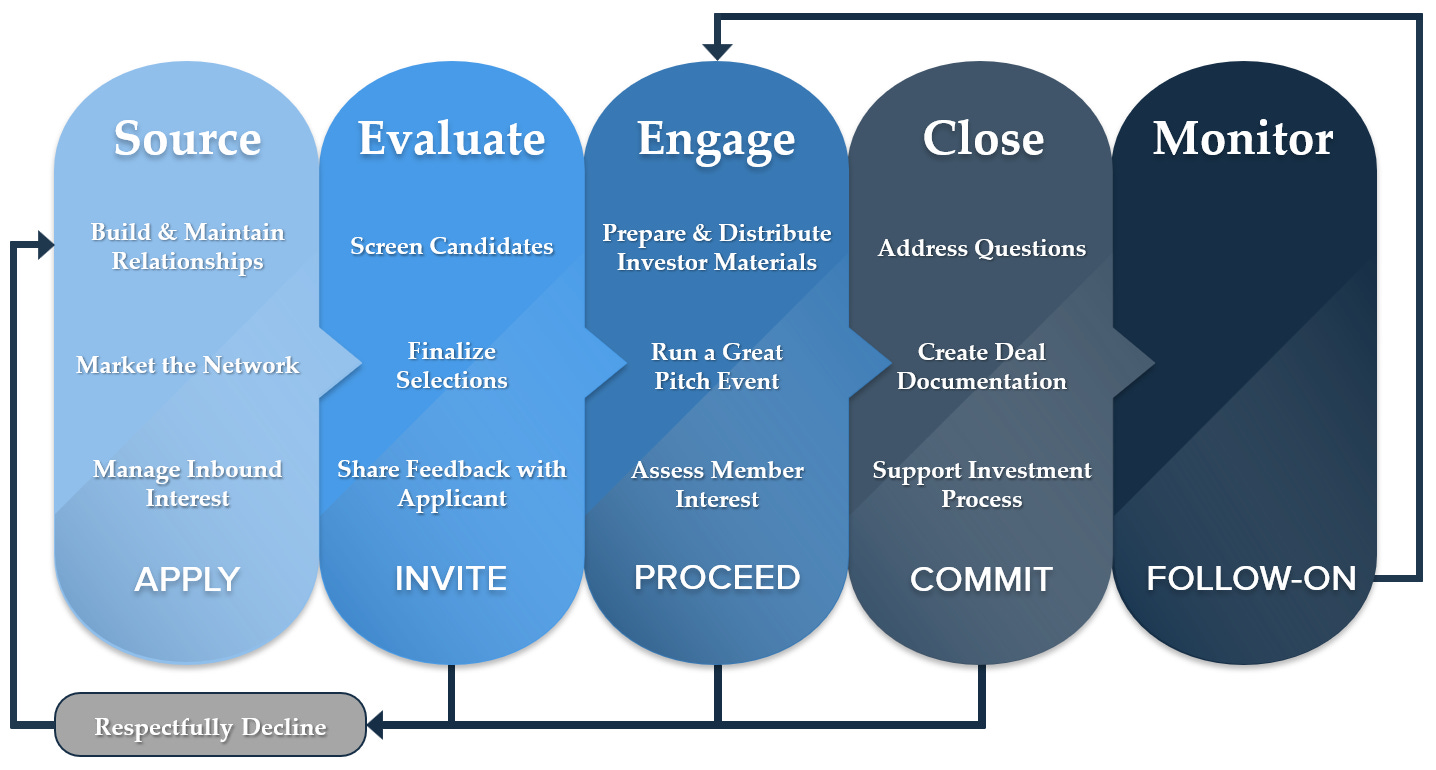

As a quick refresher, Angel Ops, which I introduced in this post, seeks to map an answer to the following question: What does the process at a world-class angel network look like? Angel Ops is focused on the backend process of running deals and groups the workflow into 5 core steps. 2 weeks ago I wrapped up the fourth step, Close. Over the next few weeks, we’ll dive into the final step: Monitor. The objective of this phase is to help community members stay up to date with the status and performance of each deal, which often drives future opportunities for investment.

Step 5: Monitor

Job: Regularly consolidate and distribute investment status updates.

Progressive Outcome: Follow-On - Members consider investing in following rounds, driving re-engagement with the network at a future date.

Within each core step, there are 3 “supporting” jobs-to-be-done that contribute to the primary job. We’ll explore each of the supporting jobs for the Monitor step in the weeks ahead. For now, let’s double-click on the overall job for the network operator at this point in the framework.

What Type of News is Most Popular?

Between 1986 and 2007, researchers surveyed nearly 200,000 American adults. The top 3 categories ranked by the average % of respondents who followed the category “very closely” were:

Disasters (39%)

Money (34%)

Conflict (33%)

Where Do Americans Get Their News?

According to a 2014 study: “People across all generations are most likely to discover news by going directly to a news organization, rather than letting the news come to them … Hearing directly from the reporting source is preferred.”

Why Does This Matter?

Because people care deeply about news related to their money. Angel network operators have the unique opportunity to serve as a trusted news source related to the deals they introduce to their members.

Questions

Here are some common questions I’ve seen and heard variations of throughout my time working with angels:

“I wonder how those other deals turned out. Did I pick the right ones? Did I miss out on a winner or dodge a bullet?”

“Gee I haven’t heard from Startup X in a while, I wonder how they’re doing.”

“When they pitched, Startup Y said something about how they were expecting to sign a new client by the end of the summer, but I haven’t heard about it since.”

“I’ve been on vacation and traveling for work so I’m super behind on emails. I wish there was a way to see updates from all my investments in one place so I don’t miss anything.”

“I’ve had 3 up rounds, a shutdown, and 2 small exits. What’s my performance so far? How does that compare to my peers? What would my ROI look like if I had just invested in everything? What’s the best deal we’ve seen as a group?”

Sound familiar?

Final Thoughts

Highly motivated angels might take the time to reach out to the companies directly. But my experience has shown that many are so busy that they simply can’t afford to, so their questions go unanswered. These topics tend to come up again and again - unless the network steps in to help. That’s why Angel Ops Step 5: Monitor, is so critical. Over the next few weeks, we’ll explore how the angel group operator can help address these questions and more for their members by breaking down three sub-jobs and diving into the practical implications of each.

What do you think?

How does your angel community help members monitor the status of deals previously considered?

Weekly Observations: 3 Lessons Learned

“Don’t commit to a strategy while you’re still learning the rules of the game.”⚽

That is some wise advice I received this week that I am, in all honesty, wrestling with. I’ve devoted a lot of time and mental energy towards the goal of making early-stage startup diligence collaborative (that is, after all, part of our mission). I love the process of experimenting, trying new things, and failing fast. But sometimes my engineering training kicks in and I overthink things to a fault. Sometimes that tendency has been deeply helpful. In this case, I think it’s been a bit of both. Shoot me a note if you’re an experienced early-stage investor interested in learning more, I’d love to hear your take on what we’ve been working on.

Giving an order is easy. Helping someone decide for themselves is hard.👮♂️

This week I had the opportunity to speak with a group of students at Startup Fast Pass on the topic of “How to Pitch.” After presenting, I spent some time bouncing from group to group to see how things were going. I was shocked at how common it was to hear students ask deterministic questions like “Should I do x or y?” I found it incredibly difficult to restrain myself from giving a binary order. However, since I believe the learning experience is far more effective when students are forced to think for themselves, I found myself re-teaching the same basic principles over and over again to help THEM decide which path was best.

Pick a niche. Then pick a niche within that niche, and become the best.🔍

This week I had coffee with an experienced entrepreneur, investor, and executive. My main takeaway? Pick a niche and become the best. This is massively effective at establishing credibility and has been deployed again and again in his experience with great success.

Thanks for reading, have a great week.

-Andrew

If you enjoyed this post, please share it with a friend, colleague, or anyone else who may benefit.

P.S. - I recently finished creating The Angel Network Toolkit: 90 Resources for Cultivating a Thriving Community of Pre-Series B Investors, and I’m sharing it with anyone who refers a friend.

How did I do this week?

About Me

I cultivate flourishing.

I'm also the CEO of PitchFact, where we help angel networks conduct efficient and collaborative diligence. I'm a proud husband, aspiring father, and grateful friend. My love languages include brisket, bourbon, and espresso.