Rocketship, Inc.

Suppose you’ve flawlessly executed the first three steps in the Angel Ops process. During Step 3, Engage, you put together a solid pre-read on each presenting company, ran a great pitch event, and discovered through your assessment process that there is between $125,000 - $165,000 of interest from 6 members in one of the presenting companies, which we’ll call “Rocketship, Inc.” However, you also learned that several members still have some questions.

This is normal. Most investors need additional engagement with an opportunity before they’re comfortable investing.

Ok but… now what?

The Observer Express

Don’t have time to read the entire post right now? No worries, here are the main points:

Closing a deal starts with answering investors’ questions about it.

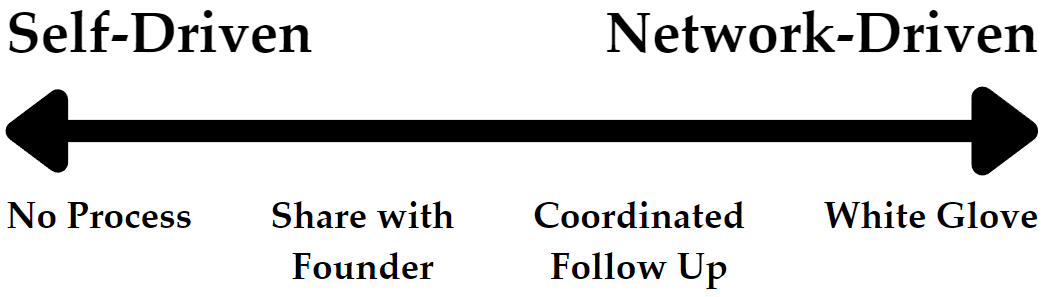

Network processes for answering these questions vary along a spectrum of “Self-Driven” to “Network-Driven,” and there are four general approaches. This is where diligence teams often enter the picture.

Angel Ops Step 4: Close, Supporting Job #1: Address Questions

As a quick refresher, Angel Ops, which I introduced in this post, seeks to map an answer to the following question: What does the process at a world-class angel network look like? Angel Ops is focused on the backend process of running deals and groups the workflow into five core steps. I recently introduced the fourth step: Close, which is focused on helping members decide whether or not to invest, and (when the decision is affirmative) culminates in an investment.

Step 4: Close

Job: Help members make a final decision on whether or not to invest.

Progressive Outcome: Commit - Members invest.

Within each core step, there are 3 “supporting” jobs-to-be-done that contribute to the primary job. This week, we’ll explore the first supporting job within the fourth step: Address Questions.

Answer Those Questions

Whether your chosen assessment process yielded a lot of information or a little, the essential next step is to take that information, consolidate it into a concise format, and do something to help members answer those questions.

In our Rocketship example, suppose you’ve collected a dozen questions. Let’s say 3 of the questions are general or fact-based - they’re about the raise, funding status, or some other biographical question. Another three are about the company’s go-to-market strategy, four are about customer traction, and two are about the market size.

Some investors will find out answers on their own. They’ll set a meeting directly with the founder or conduct independent research. However, many won’t be entirely self-motivated and will look to the network to facilitate. And even for those more motivated investors, if the network is willing to step in to help coordinate the process, they appreciate the help.

So, how does this look practically?

It Ranges from “Self-Driven” to “Network-Driven”

Like so many other steps in Angel Ops, I see networks handle this job in various ways. However, the four methods I’ve observed generally fall along a spectrum ranging from “Self-Driven” to “Network-Driven.”

No Process

This is the “DIY” approach. It’s the lowest cost and most straightforward method to get going with. Members are on their own. They’re expected to follow up with founders directly if they have questions. This works well for groups of investors who prefer to operate independently. Anyone interested in Rocketship can follow up if they choose.

Share with Founder

This approach involves simply sharing the consolidated list of questions with the founder and inviting them to respond. This is most often done via email or web platform, where the founder is provided with a consolidated list of the questions members proposed and asked to respond to the entire group. This also has the benefit of helping members see what other members are asking and thinking about. Anyone interested in Rocketship is cc’d on an email chain with the founder, where member questions are shared and responded to.

Coordinated Follow Up

This model is more involved than the “Share with Founder” approach. Here, a specific follow-up step (or series of steps) is organized, such as a deep-dive discussion. The network operator presents the founder with the questions asked by members, and the founder responds. Members are often invited to engage during these discussions, ask additional questions, or submit them beforehand. Anyone interested in Rocketship can participate in a recorded follow-up meeting and offer any other questions.

White-Glove

This model is the most work for the network operator but requires the least work from members. Here, the operator takes responsibility for tracking down answers to all the questions members ask. This is done through work directly with the founder and independent research by network staff, diligence team leaders, or other third-party support organizations. Anyone interested in Rocketship is personally contacted by network staff and engaged directly when new information is available.

Where Does the “Diligence Team” Fit In?

It depends on the process, but this is generally the point at which some communities facilitate the formation of a dedicated diligence team if there is substantial interest. These team members will work with a combination of the specific questions and a “diligence template” to draw out as much information for the community’s consideration as possible. This process can take weeks or months, depending on the scope of the investment, and often involves multiple follow-up meetings.

Final Thoughts

Establishing and managing processes for effectively addressing investor questions is a challenging task. But these efforts are a significant value-add for many community members and form the critical first step in closing a deal.

What do you think?

How does your network handle addressing member’s questions? What approaches do you find to be most effective?

Weekly Observations: 3 Lessons Learned

The lobby >>>> the audience.🤝

Last week, I had a blast attending Dallas Startup Week. My favorite part of the event? Standing in the lobby. All. Day. Long. I admit I caught some of the content, which I enjoyed. But I continue to find that braving the awkwardness of walking up to a stranger and saying, “Hi, I’m Andrew. What’s your story?” is the most engaging, productive, and fun part of any event. Programming is great, but getting to know other interesting humans is ten times better. If you’re one of the dozens of new founders, investors, or other participants in the startup ecosystem who I met last week, thanks for saying hi.

Talk less = sell more.🤐

Me: “Why don’t you like product X?” (referring to a tool we’re currently researching) Client: “I did. But when I met with the founder, I could never get a word in edgewise and was so put off by the sales approach that I never gave it a second look. If he had said less and just let me buy the thing, I might be a happy customer today.” Wow. Talk about validation for the “shut up and listen” sales approach.

There’s a big difference between research and analysis.🔍

One prospect’s process involves highly detailed preliminary research. The document they produce for each deal is dozens of pages long and very detailed. We’re scoping a single-page market analysis that will fit into their process after completing this preliminary research. When asked why they’re so interested despite our product’s concise nature, the response was, “sorting through all the data and focusing analysis on the most important things is hard to do well. That’s why we’re interested.”

Thanks for reading, have a great week.

-Andrew

If you enjoyed this post, please share it with a friend, colleague, or anyone else who may benefit.

P.S. - I recently finished creating The Angel Network Toolkit: 90 Resources for Cultivating a Thriving Community of Pre-Series B Investors, and I’m sharing it with anyone who refers a friend.

How did I do this week?

About Me

I cultivate flourishing.

I'm also the CEO of PitchFact, where we help angel networks conduct efficient and collaborative diligence. I'm a proud husband, aspiring father, and grateful friend. My love languages include brisket, bourbon, and espresso.