Tracking Startup Performance

Methods for angel network operators to track company metrics over time

Potential -> Reality

Every angel investment begins with massive potential.

There’s a real problem to be solved, and this company thinks they’ve found a way to solve it. They’ve mapped out a great plan, have a solid team, are surrounded by experienced advisors, and have secured some early traction. They successfully closed their latest financing round, and everything is looking up.

But after the ink dries on the closing documents, how do we map a startup’s potential to reality?

By tracking their performance over time.

That’s where the “Monitor” section of Angel Ops comes in, and today we’ll discuss the first step: tracking company metrics.

The Observer Express

Don’t have time to read the entire post right now? No worries, here are the main points:

The first step to effectively monitoring a portfolio of past angel network presenters is to establish and follow a system for consistently tracking company performance.

The system should be built after defining preferences on startup selection, cadence, and tracking methodology.

There are two ways to collect metrics: push and pull.

Keeping it simple and organized is key to success.

Angel Ops Step 5: Monitor, Supporting Job #1: Track Company Metrics

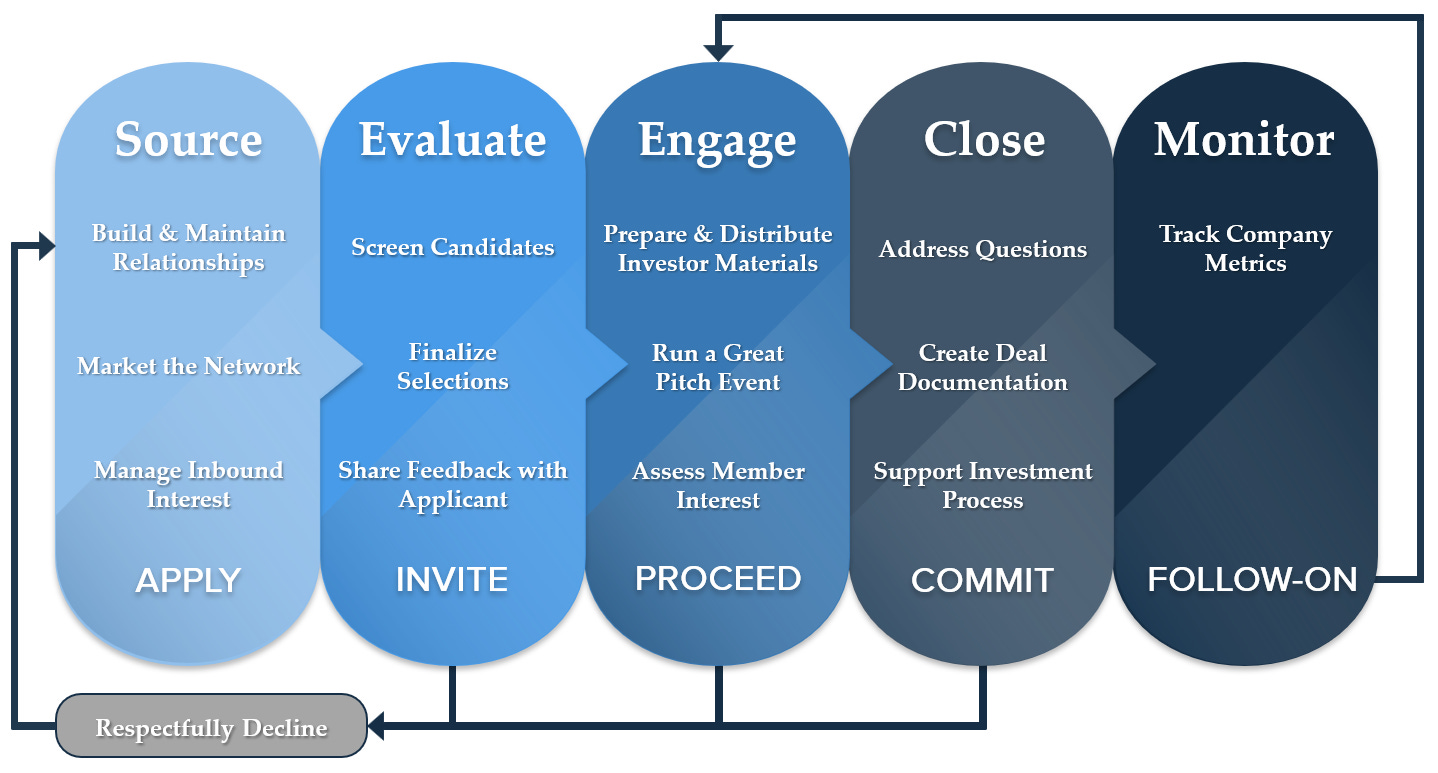

As a quick refresher, Angel Ops, which I introduced in this post, seeks to map an answer to the following question: What does the process at a world-class angel network look like? Angel Ops is focused on the backend process of running deals and groups the workflow into five core steps. Last week, I introduced the fifth and final step: Monitor, which is focused on helping community members stay up to date with the status and performance of each deal, which often drives future opportunities for investment.

Step 5: Monitor

Job: Regularly consolidate and distribute investment status updates.

Progressive Outcome: Follow-On - Members consider investing in following rounds, driving re-engagement with the network at a future date.

Within each core step, there are 3 “supporting” jobs-to-be-done that contribute to the primary job. This week, we’ll explore the first supporting job within the fifth step: Track Company Metrics.

Step 1: Get the Info

The first step in effectively monitoring a startup is knowing what’s going on.

For public firms, this is fairly straightforward: read the quarterly 10Q and annual 10K. Updates are required by the SEC for publicly traded companies at least quarterly, and other updates are often published when newsworthy events take place.

But for small, privately held startups, it’s a different story. Reporting requirements are far less stringent, so most founders simply maintain an email list where they send monthly, quarterly, or annual updates to their investors and/or general supporters. Every founder follows a different format, and it can vary significantly from company to company.

Therefore, it’s essential for an angel network operator seeking to keep up with dozens of startups to build and maintain a system for tracking company status.

System Design

What should that system look like?

That depends on the operator’s position on the following 3 categories:

Selection

Which startups are we going to track? Will we keep up with every startup that presents, only deals that receive investment, or some other approach?

Cadence

How regularly do we want to review each deal? Monthly, quarterly, annually, or something else entirely?

Methodology

What metrics do we care about? Do we want the same information across all our startups, do we segment by industry/vertical, or do we simply report what the founders share?

Once the group’s position on each of these categories has been defined, the appropriate system can be constructed.

Push or Pull?

When it comes to the actual mechanics of collecting the data, there are two basic formats:

Push

This is information sent out (or “pushed”) by the founder. Most often, this takes the form of a newsletter, meeting, or other communication initiated by startup leadership.

Pull

This is information sought out (or “pulled”) by the network. This could be an email to the startup leadership team asking for an update, a recurring meeting set by the investor, an annual survey, etc.

The chosen selection, cadence, and methodology directly influence which of these methods are leveraged, though most often I see a combination of the two employed.

KISS

Regardless of what and how information is collected, a central theme to keep in mind is simplicity and organization. These lists can very quickly evolve into hundreds or thousands of companies, and that is a tremendous burden to manage. So keeping things simple and organized is non-negotiable.

There are some great tools out there to help with this, but something as simple as assigning an administrator to manage a simple spreadsheet with each company’s basic information and metrics over time can be a major benefit to network members.

Final Thoughts

Effective monitoring begins with a thoughtfully designed and consistently executed system for tracking company metrics. Angel network operators rely on a combination of push and pull communication depending on their chosen system, but it’s essential to keep things organized no matter what. Next week, we’ll continue our discussion by breaking down a few methods for sharing these updates with our members.

What do you think?

How does your angel community track company metrics over time?

Weekly Observations: 3 Lessons Learned

Be a valuable signal.📶

This week I was discussing the importance of sharing deal flow across angel groups with a network leadership team here in Texas. One of the things they said was “Deal flow is not a problem - quality deal flow is a problem. If you want to stand out as a valuable signal to the market, work to become a source of quality, not quantity.”

Our answer to “What did you think?” is valuable.💭

I’m learning that clients consistently want to know what we think of an opportunity. Beyond the “official” analysis we produce, there’s interest in knowing what informally stuck out to us, what our impressions were, and why. It’s a good question to ask because we’re often spending dozens of hours researching and studying a given startup to prepare their diligence material.

It’s tempting to sacrifice work on the business when there’s a lot to do in it.🛠️

This week we had 24 diligence modules to produce on 6 different companies. That’s a lot of work to do, so it’s very tempting to block off the calendar and spend zero time managing the business or pursuing important relationships in order to make sure we deliver with quality. This is a tension I personally deal with constantly as we continue to grow.

Thanks for reading, have a great week.

-Andrew

If you enjoyed this post, please share it with a friend, colleague, or anyone else who may benefit.

P.S. - I recently finished creating The Angel Network Toolkit: 90 Resources for Cultivating a Thriving Community of Pre-Series B Investors, and I’m sharing it with anyone who refers a friend.

How did I do this week?

About Me

I cultivate flourishing.

I'm also the CEO of PitchFact, where we help angel networks conduct efficient and collaborative diligence. I'm a proud husband, aspiring father, and grateful friend. My love languages include brisket, bourbon, and espresso.